MO Form E-1R 2024-2026 free printable template

Show details

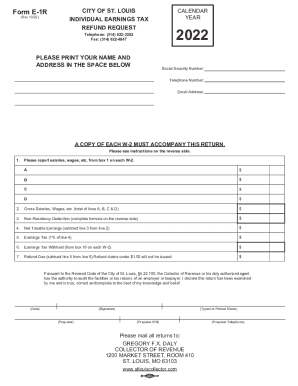

Form E-1R Rev 06/24 CITY OF ST. LOUIS INDIVIDUAL EARNINGS TAX REFUND REQUEST CALENDAR YEAR Telephone 314 622-4403 Fax 314 622-4847 PLEASE PRINT YOUR NAME AND ADDRESS IN THE SPACE BELOW Social Security Number Telephone Number Email Address A COPY OF EACH W-2 MUST ACCOMPANY THIS RETURN. Please see instructions on the reverse side. Stock options not represented on the W-2 will require documentation from your employer. Please use Form E-1 if you owe the City of St. Louis Earnings Tax. Form E-1R...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form e 1r

Edit your st louis city form e 1r form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your e 1r form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing missouri 1r tax online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit pdffiller form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO Form E-1R Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form e 1

How to fill out MO Form E-1R

01

Obtain the MO Form E-1R from the official website or local office.

02

Fill in your personal information in the designated fields, including your name, address, and contact details.

03

Provide your tax identification number or Social Security number as required.

04

Indicate the tax year for which you are filing the form.

05

Complete the sections regarding income and deductions by following the instructions provided on the form.

06

Review your entries for accuracy and completeness.

07

Sign and date the form to certify that the information provided is true and correct.

08

Submit the form by mail or electronically as instructed.

Who needs MO Form E-1R?

01

Individuals or businesses that are required to report income and pay taxes in the state of Missouri.

02

Taxpayers seeking to claim specific credits or deductions eligible under Missouri state tax law.

Fill

sales tax st louis

: Try Risk Free

People Also Ask about select the correct answer which document do you need to have on hand when preparing to file your tax return a auto insurance card b birth certificate c driver s license d form w 2 e form w 4

What is St. Louis City tax for employees?

St. Louis City Code, Chapter 5.22, first adopted in 1959, imposes a payroll earnings tax of 1% that applies to the earnings of its residents and, under Section 40(C), to the earnings of nonresidents that are “reasonably attributable to work done, or services performed or rendered, in the City.” The City of St.

What is the St Louis City earnings tax lawsuit?

The lawsuit was filed in 2021, after the plaintiffs, Mark Boles, of St. Louis County, and Kos Semonski, of St. Charles County, were denied earnings tax refunds for 2020. In previous years, the city had issued them and thousands of others rebates for days they traveled and worked outside city limits.

Who needs to file a St Louis tax return?

Residents of the City of St. Louis, regardless of the location of their employer. Employees of businesses located or performing work/services within the City of St. Louis, regardless of where they live.

Do I have to pay St Louis City tax?

Anyone with a permanent address in the City of St. Louis will be required to file on 100% of their earnings.

How much is St. Louis City tax?

The Missouri sales tax rate is currently 4.23%. The County sales tax rate is 0%. The Saint Louis sales tax rate is 5.45%.

What is an E 1 form?

Form E-1 is a tax return used by a resident individual taxpayer, regardless of the location of their employer, or a non-resident working in the City of St. Louis to file and pay the earnings tax of 1% due and not withheld by the employer.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in eor for missouri without leaving Chrome?

st louis missouri sales tax can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an electronic signature for the e1 form in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your sales tax st louis missouri and you'll be done in minutes.

How can I fill out sales tax for st louis mo on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your eor missouri from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is MO Form E-1R?

MO Form E-1R is a tax form used in Missouri for reporting certain income tax information by businesses and individuals.

Who is required to file MO Form E-1R?

Businesses and individuals who have specific income tax obligations or qualify for certain tax credits in Missouri are required to file MO Form E-1R.

How to fill out MO Form E-1R?

To fill out MO Form E-1R, you need to provide requested personal and business information, income details, and tax calculations as instructed on the form.

What is the purpose of MO Form E-1R?

The purpose of MO Form E-1R is to ensure proper reporting and compliance with Missouri state tax laws for income and applicable credits.

What information must be reported on MO Form E-1R?

Information such as taxpayer identification, types of income, deductions, adjustments, and tax credits must be reported on MO Form E-1R.

Fill out your MO Form E-1R online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

E 1 Form is not the form you're looking for?Search for another form here.

Keywords relevant to st louis city earnings tax form

Related to form e1

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.